In today’s world, where financial decisions impact nearly every aspect of life, it’s surprising how few of us receive formal financial education. National Education Day presents an ideal opportunity to reflect on this gap in our educational system. Financial literacy, encompassing skills such as budgeting, saving, debt management, and investing, is not just beneficial—it’s essential.

Table of Contents

National Education Day: Why Financial Education Matters

Financial literacy has the power to change lives. It affects how individuals manage their money, make purchases, save for the future, and handle debt. Yet, despite its importance, financial education is often overlooked in schools, leaving students unprepared for real-world financial challenges.

Basic Financial Skills as Life Essentials

To live a financially secure life, individuals need a few core skills. These include the ability to budget, save, manage debt, and make smart investments. Each of these skills plays a critical role in building financial resilience and security.

Understanding Budgeting

is one of the most fundamental aspects of financial management. It involves tracking income and expenses to ensure one doesn’t spend more than they earn. This skill, when taught early, can set the foundation for a lifetime of responsible financial behavior.

The Role of Saving in Financial Security

Saving is about putting money aside for future needs, whether for emergencies, education, or retirement. The sooner one learns to save, the more financially stable they become over time. Schools can introduce simple saving concepts that students can practice, such as creating a piggy bank or a savings jar.

Managing Debt Responsibly

Debt, when mismanaged, can become a significant burden. Learning how to handle debt responsibly, understanding interest rates, and knowing the difference between good and bad debt are lessons that can prevent future financial struggles.

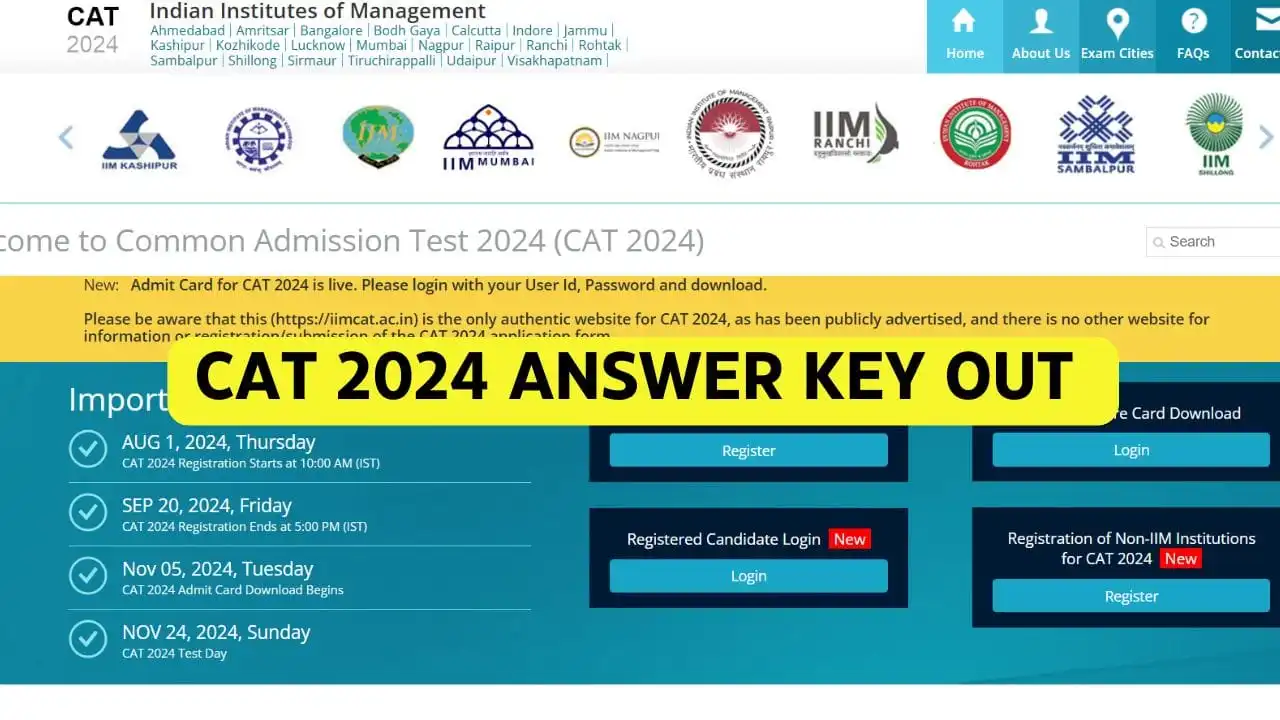

National Education Day: Introduction to Investing

Investing might seem complex, but it’s essential for long-term wealth building. By teaching students the basics of investment, such as the concept of compound interest and risk management, schools can empower them to grow their wealth responsibly.

Current State of Financial Education in Schools

In many educational systems, financial literacy receives limited attention. A majority of schools do not have a dedicated curriculum for financial education, leaving a significant gap in practical life skills for students.

Why Financial Education Isn’t Yet a Priority

Several reasons contribute to the lack of emphasis on financial education. These may include an overcrowded curriculum, a lack of trained educators, or the perception that financial education falls under parental responsibilities.

National Education Day: Examples of Countries Leading in Financial Education

Some countries, like Australia and the United Kingdom, have integrated financial literacy into their school programs with impressive results. These models offer valuable insights into how a structured financial education curriculum could look.

Benefits of Introducing Financial Education Early

Starting financial education at a young age has profound effects. Early exposure to money management principles helps students develop positive habits, fostering a generation of financially responsible adults.

Real-World Skills for Future Stability

Financial literacy isn’t just about handling money. It also teaches skills like planning, patience, and decision-making. These skills translate well into other areas of life, making financial literacy essential for personal and professional success.

National Education Day: What Financial Education Could Look Like in Schools

A structured financial education curriculum could cover essential topics like budgeting, saving, and investing, gradually introducing more complex concepts as students grow. For younger students, this could mean simple lessons on saving. Older students could learn about budgeting, debt, and investment basics.

Role of Technology in Financial Education

Modern digital tools like budgeting apps, financial games, and simulation platforms can make learning finance interactive and engaging. These tools provide practical experience, allowing students to apply what they’ve learned in a virtual setting before facing real-world financial decisions.

Conclusion

In an increasingly complex financial world, financial literacy is not a luxury; it’s a necessity. Integrating financial education into our school systems could change lives, preparing young people for a future where they can make sound financial decisions with confidence. National Education Day is a reminder of the work still needed to ensure that every student has the knowledge and tools to build a secure financial future.

FAQs

- Why is financial literacy important for young people?

Financial literacy provides young people with the skills to manage money, make informed decisions, and avoid debt, which is crucial for future stability. - At what age should financial education begin?

Financial education can start as early as primary school, with simple concepts like saving and spending, gradually building to more complex topics. - What are the core components of financial literacy?

Core components include budgeting, saving, debt management, and understanding investment basics. - How does financial education affect future career success?

Financial literacy promotes responsibility, planning, and decision-making, which are valuable skills in both personal finance and professional life. - Can financial education reduce debt issues in society?

Yes, by teaching people how to manage debt, avoid unnecessary loans, and make informed financial choices, financial education can help reduce societal debt issues.